Finance: Conversational Banking

Conversational Banking uses AI technologies to create a digital assistant as a central point of contact for bank customers. The conversation comes to the fore.

Right at the beginning of a customer journey, customers are involved in a dialogue

They are enabled to interact intuitively. This measurably improves the customer experience. Financial service providers create a flexible and personalised service that significantly increases the chances of building successful relationships with their customers.

Conversational Banking is already happening

DNB Bank has automated 51 percent of its chat conversations (Source)

Conversational banking can accelerate your revenue growth by 25 percent and reduce costs by up to 30 percent, according to a report by Accenture.

It’s on the rise

Conversational Banking integrates messaging apps and voice assistants into the customer experience of a bank. Including all advantages that text chat, voice chat, and graphic elements offer for successful communication.

Whenever it comes to service, customers attach great importance to communication.

This requires a high investment in competent employees, that are and remain indispensable for customer service. In addition, a bank can use a digital assistant for routine matters.

An AI-based chatbot can e.g., answer frequently asked questions. That way, routines get completed for a fraction of the previous costs, and at the same time, the customers' waiting times get eliminated.

Employees are now enabled to focus on complex questions and problems that require a lot of empathy and judgment.

Banking involves an immense amount of communication.

An AI-supported conversation system is therefore an ideal companion. The AI answers a large part of the standard questions and employees solve complex individual cases.

In customer service, a few repetitive questions are often responsible for a large part of the communication. Conversational banking plays a significant role in giving quick responses to customers, even when the volume of communication is high. That strengthens customer relationships and gives you the freedom of offering certain financial services all around the clock.

Voice applications can also help customer service staff engage with customers. Therefore, banks are starting to integrate AI-driven chatbots into their customer experience design. As well as supporting conversations between customers and employees through AI applications.

This trend was triggered by a shift in mobile communication from SMS to instant messaging. While many industries have been quick to explore the possibilities of messenger apps, the financial sector has been somewhat reluctant, but is now catching up.

Those who now build an interface for conversational banking can build on valuable experience.

You can set the right course for a future-proof platform on which your customers can use text and voice chats for their concerns as a matter of course. This requires experts like voice user interface designers or computer linguists.

With their skills, you open the possibility to design a trusting interface with which customers are happy to enter a dialogue.

Conversational Banking opens doors

Be where the customers are

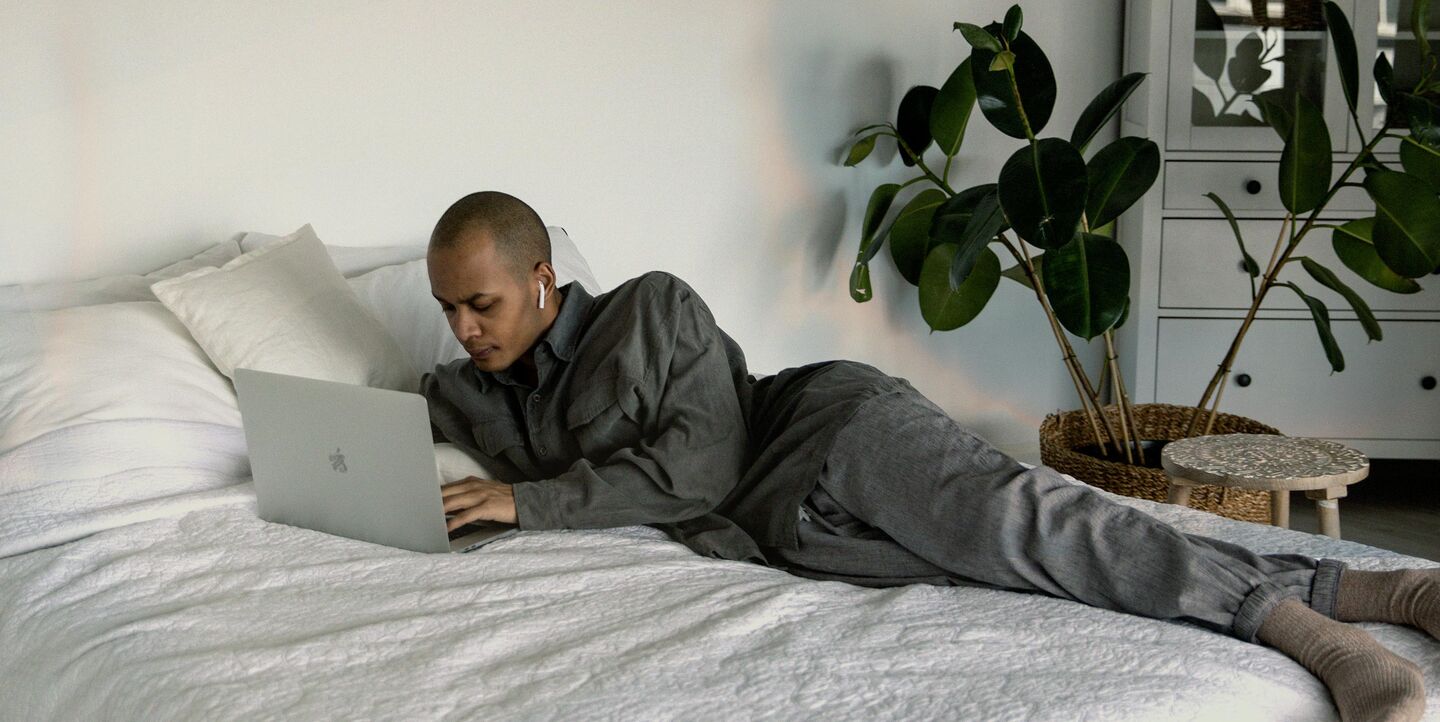

Customers spend a lot of time online on their computers or smartphones. And the use of messenger services has increased significantly in recent years.

This is a good opportunity for banks to adapt to their customers' forms of communication. Because many people do not want to be tied to a specific communication channel, but rather choose their preferred form of communication.

Being available for your customers 24/7

A conversational interface offers the possibility of being ultimately available as soon as customers have a problem – regardless of their current location.

In addition, a voice assistant in customer service can be scaled up. This means that banks are well-prepared for situations in which the volume of communication suddenly increases immensely. Also, customers are much less likely to get stuck in a queue.

Conversations create connections

A customer dialogue offers more possibilities than, a mere presentation of text on the website. That is because conversations can convey many more emotions.

And here comes a crucial point: Since there are fewer and fewer bank branches, new ways of getting close to customers are heavily needed.

Here is where a conversational interface offers you a unique opportunity. For example, as a chat application on the homepage or integrated into the banking app. A cleverly designed conversational banking platform processes customers' concerns centrally and in a network

The possibilities of a Conversational User Interface in banks are almost unlimited. Now, the focus is on automating customer service.

But in the future, there is the possibility that Robo-advisors will go into conversation with customers. They will advise on all financial matters or help to save for the dream house... 24/7!

How can I use conversational banking for my financial business

Conversational-Banking-Strategien bilden die Grundlage für einen erfolgreichen Kundenservice. Zum Beispiel durch einen Chatbot, der Informationen rund um Hypotheken bereithält.

Solange die Möglichkeit besteht, bei Bedarf mit eine*r Berater*in zu sprechen, können digitale Tools die Customer Experience erheblich aufwerten.

Customer Support:

Text messaging for real-time support

Sales:

Chatbot and co-browsing for account openings

Consulting:

Digital assistance and video chat for mortgage advisory service

The focus is on people

At Ideabay.ai, we believe in conversational banking as a reflection of how customers will be integrating banking into their future daily lives.

Not exclusively via mobile phone, video, or in person – but through a combination of all these things. This requires a multimodal approach to conversational banking.

The best conversations are still people-to-people conversations. But: they can be facilitated and supported by technology in the best possible way. Conversational banking combines linguistic know-how and AI with the human ability to get in touch with other people.

Let's talk!

Are you looking for your way into Conversational Banking? We look forward to an exchange with you. Let's talk about how digital assistance can represent your bank.